Are you aiming to hit specific marketing targets but finding it challenging to keep track of progress across multiple channels? Nexoya’s latest feature, the Target-based portfolio, is here for you. This new portfolio type is designed to align closely with your business objectives, enabling you to achieve your goals with greater efficiency and precision.

What is the Target-based Portfolio?

The Target-based Portfolio is a new portfolio type that is designed to optimize your cross-channel campaigns towards achieving specific portfolio targets, such as CPA (Cost Per Acquisition) or ROAS (Return On Ad Spend).

Simply put, this new portfolio type stands out by allowing you to:

- Set Cross-Channel Targets: Seamlessly transform your business goals into actionable marketing targets, easily monitored across various platforms.

- Customize Your Targets: Define a portfolio-wide target across various advertising channels to be achieved within a specific timeframe. You can set goals focusing on:

- Cost / Performance targets (CPx)

- Performance / Cost targets (ROAS/ POAS)

This level of customization provides a tailored strategy that aligns with your unique business goals and the dynamics of the market.

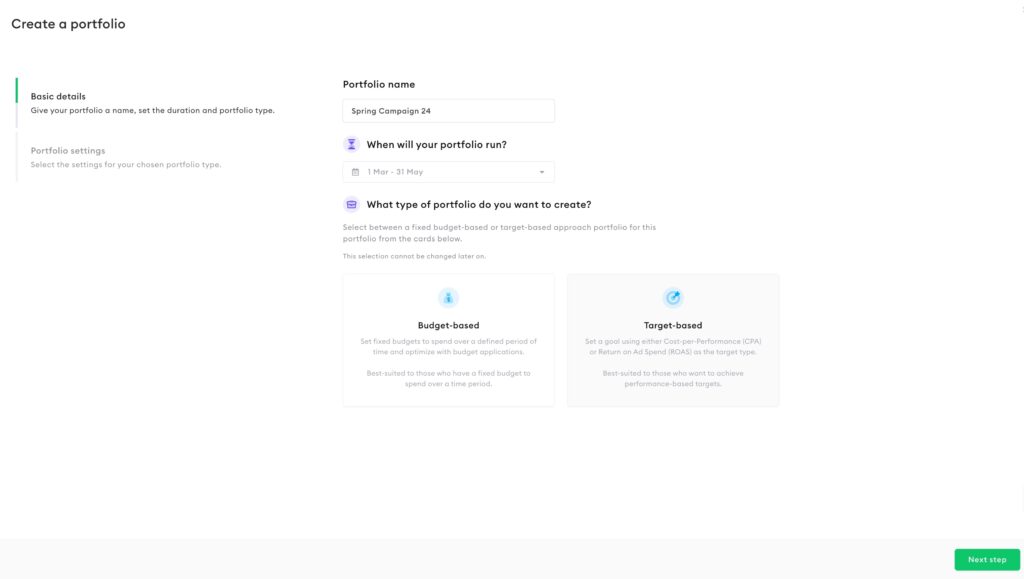

Budget-based vs. Target-based Portfolio: Understanding the Differences

Nexoya now offers two portfolio types: budget-based and target-based, each catering to different optimization goals.

- Budget-based Portfolios are designed to maximize performance within a predetermined budget.

- Target-based Portfolios focus on achieving specific marketing target goals (e.g. CPA, ROAS), using the budget as a tool to reach these objectives. This portfolio type allows for adjustable pacing towards targets, constrained by an upper budget limit.

What Portfolio Type Fits My Needs?

If your primary objective is to reach a specific performance target, with budget considerations being secondary, the Target-based portfolio is the ideal choice. Keep in mind that even though considered as “secondary”, the budget will still be capped and will not exceed your defined budget limit.

Whereas budget-based portfolios are perfect for the scenario when you would like to achieve the best possible performance with the given budget.

How It Works

- Performance Forecasting: By leveraging AI and machine learning, Nexoya predicts campaign performance at the ad-set level and proposes budget and target adjustments. This ensures that resources are intelligently allocated to meet your goals.

- Data-driven Budget Reallocation and/or Target Changes: Dynamically adjust spending across campaigns to optimize target achievement. Nexoya aims to reach the selected target while staying within the expected budget limits and respecting the specified risk level.

Key benefits

- Target-oriented Optimization: Direct your marketing efforts towards specific targets for more effective outcomes.

- Cross-Channel Goal Setting: Align your marketing across all channels towards a singular business objective, improving budget effectiveness.

- Gradual Approach vs. Instant Achievement: Control how fast the target will be approached. Whether you’re planning for long-term growth or need immediate results, the flexibility of this module lets you decide the pace at which targets need to be reached.

- Easily Adapt Your Targets: Easily redefine portfolio targets to adapt to changing priorities.

- Regular Updates and Improvements: Nexoya is dedicated to the continuous enhancement of the Target-Based Portfolio module, incorporating customer feedback and adapting to market trends.

How to work with a Target-based portfolio?

1. Create a New Portfolio

Navigate to the “Portfolios” main menu by clicking on Portfolio symbol. Click on “Create portfolio” and select the Target-based type.

💡 Note: Portfolio type can’t be changed once portfolio has been created

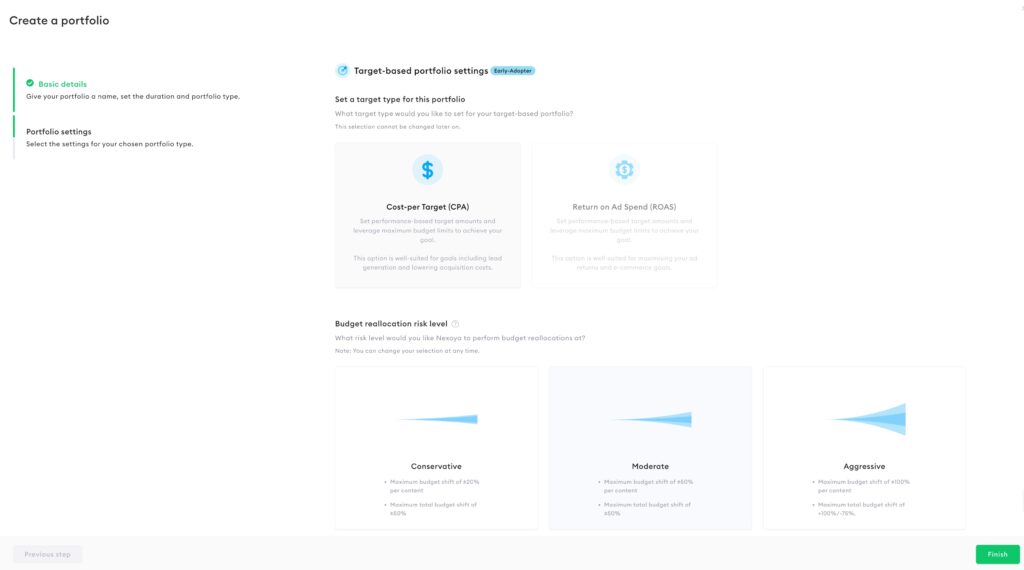

2. Select a Target Type

Choose between two target types:

- CPA: This option is well-suited for goals including lead generation and lowering acquisition costs.

- ROAS Target: This option is well-suited for maximizing your ad returns and e-commerce goals.

3. Determine the Pace by Setting Your Risk Level

Configuration of the risk level allows you to determine the pace at which you aim to achieve your target, considering budgetary constraints. A higher risk level accelerates the pace, allowing you to approach your target more rapidly.

You have the choice among three strategies:

- Conservative: Maximum budget shift of ca 50% per content with the maximum total budget shift of ca 20%

- Moderate: Maximum budget shift of ca 75% per content with the maximum total budget shift of ca 50%

- Aggressive: Maximum budget shift of ca 200% per content with the maximum total budget shift of ca 100%

💡 Note: You can adjust your risk level at any time.

Be mindful of potential delays in performance metrics due to attribution and other factors.

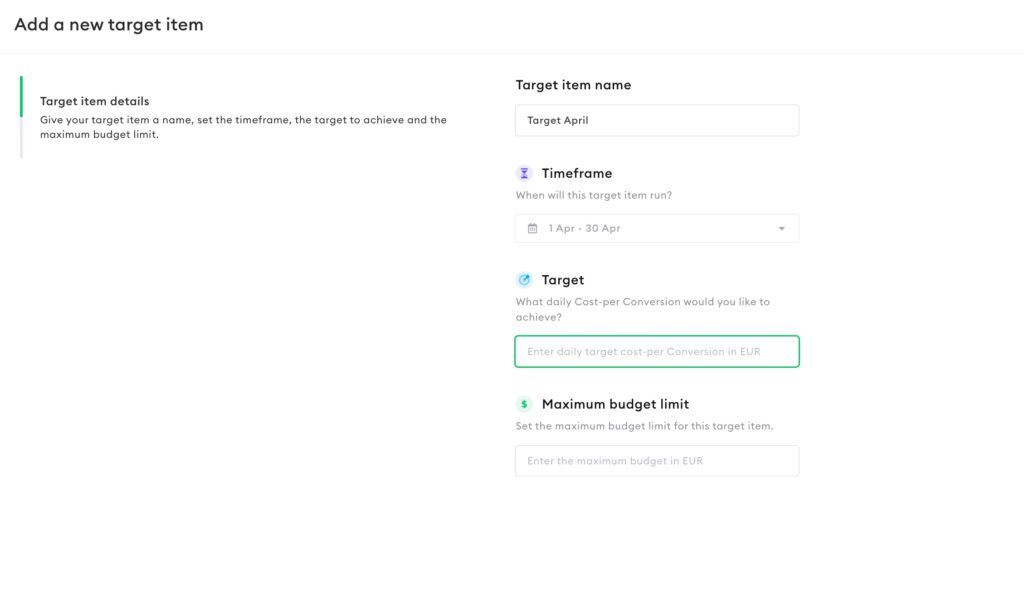

4. Define Target Items

Set your targets by creating the target items.

Each target item serves as a customizable component where you can fine-tune your target settings:

- Name Your Target: Assign a unique name to each target for effortless identification and tracking in the future.

- Specify the Timeframe: Determine a specific duration for each target to operate within.

- Determine Your Daily Target Value: Set a daily target cost.

- Establish a Total Budget Limit: Define the ceiling for your spending for the target item.

- Expand Your Strategy: Feel free to create multiple target items, ensuring their timeframes do not overlap.

💡 Pro Tip: Achieving the best results begins with setting achievable targets. Therefore, make sure you set realistic targets. You can always consult with your customer success manager and get advice on setting your targets.

5. Monitor Your Progress

Use the Target tab to track your target achievement progress as well as keep track of your ad expenditure.

Explore two views that are available here:

- Overview: Gain insights into your target approximation—essentially, measure how close you are to reaching your goal. This view highlights the progression of your daily portfolio target achievements in relation to the predefined portfolio target.

- Pacing: This view focuses on your current budget allocation, presenting an up-to-date report on expenditures. It also features the option to activate a channel breakdown, giving you a granular view of your investment distribution across different channels.

Optimization Proposal Specifics for Target-based Portfolio

Considering the difference in focus compared to classic Budget-based portfolio, Target-based portfolio has its own specifics when it comes to the optimization proposal view:

- Unlike the “Optimizing for” parameter seen in Budget-based portfolios, the Target-based portfolio introduces the “Optimization Target” within the optimization proposal interface.

- Important to mention that while reaching the portfolio target remains a central goal, the performance of impact groups is also considered to ensure balanced optimization.

- Additional information provided in the proposal for suggested portfolio target value, predicted baseline and the forecasted percentage uplift, in total and broken down per impact group and channel.